Corporate Life Sciences

-

Our work on behalf of life sciences clients includes:

-

Strategic General Counsel, Advising on a Comprehensive Scope of Business Operations and Issues

Whether we are working with emerging or established companies, or with investors, our clients benefit from our holistic approach to enterprise building, our strategic IP counseling, and our deep relationships with life sciences entrepreneurs, innovators, investors, start-up incubators and accelerators, and research institutions.

-

A Nationally Recognized and Ranked Life Sciences Practice

Recognized as a “Leading Firm” for Life Sciences—in Nationwide, California, and Massachusetts categories—in the 2023 edition of Chambers USA: America’s Leading Lawyers for Business. Wilson Sonsini was also named a finalist in three “Firm of the Year” categories of the LMG Life Sciences 2023 Americas Awards: Licensing and Collaboration, Patent Strategy, and Venture Capital.

Life Sciences innovators turn to Wilson Sonsini’s corporate life sciences team so they can concentrate on breakthrough science, trusting us to help them transform their ideas into a viable enterprise with a cohesive intellectual property and regulatory strategy poised to attract institutional financing and achieve an attractive exit. For over 60 years, we have worked closely with our clients through every stage of their companies’ life cycles, helping over 1,000 private life sciences companies on matters ranging from formation to IPO and strategic partnerships. Coordinating seamlessly with our patents and innovations and technology transfer groups, we are counselors and strategic advisors to our clients, with unparalleled expertise in advising emerging growth companies, venture finance, M&A, strategic partnering, and IPOs. Our experience and strong relationships with our clients allow us to provide pragmatic and creative advice that helps them thrive through ever-changing economic and funding environments, weathering short-term ups-and-downs while ensuring the achievement of long-term growth and exit goals.

More than 100 of our patents and innovations legal professionals hold Ph.D.s and have significant experience in the life sciences industry. Our team also includes experts in technology transactions and commercialization, regulatory and compliance issues, and corporate matters, including former senior technology licensing executives at top-tier research universities and former in-house legal counsel for major life sciences companies.

Whether we are working with emerging or established companies, or with investors, our clients benefit from our holistic approach to enterprise building, our strategic IP counseling, and our deep relationships with life sciences entrepreneurs, innovators, investors, start-up incubators and accelerators, and research institutions.

For each client, we create a robust four-pillar strategic framework for maximizing the company’s chances of reaching its business objectives:

- a comprehensive IP strategy with clear guideposts for the steps necessary to achieve funding milestones, including a strategy for any potential in-licensing of third-party IP,

- a coordinated regulatory strategy to avoid self-inflicted wounds down the road and increase attractiveness to investors or acquirers,

- a financing and commercialization strategy that matches the company’s regulatory milestones and value inflection points with the optimal sources of capital each stage of its development, and

- a corporate strategy that supports future growth while minimizing risks and maximizing tax efficiencies.

Life Sciences innovators turn to Wilson Sonsini’s corporate life sciences team so they can concentrate on breakthrough science, trusting us to help them transform their ideas into a viable enterprise with a cohesive intellectual property and regulatory strategy poised to attract institutional financing and achieve an attractive exit. For over 60 years, we have worked closely with our clients through every stage of their companies’ life cycles, helping over 1,000 private life sciences companies on matters ranging from formation to IPO and strategic partnerships. Coordinating seamlessly with our patents and innovations and technology transfer groups, we are counselors and strategic advisors to our clients, with unparalleled expertise in advising emerging growth companies, venture finance, M&A, strategic partnering, and IPOs. Our experience and strong relationships with our clients allow us to provide pragmatic and creative advice that helps them thrive through ever-changing economic and funding environments, weathering short-term ups-and-downs while ensuring the achievement of long-term growth and exit goals.

More than 100 of our patents and innovations legal professionals hold Ph.D.s and have significant experience in the life sciences industry. Our team also includes experts in technology transactions and commercialization, regulatory and compliance issues, and corporate matters, including former senior technology licensing executives at top-tier research universities and former in-house legal counsel for major life sciences companies.

Whether we are working with emerging or established companies, or with investors, our clients benefit from our holistic approach to enterprise building, our strategic IP counseling, and our deep relationships with life sciences entrepreneurs, innovators, investors, start-up incubators and accelerators, and research institutions.

For each client, we create a robust four-pillar strategic framework for maximizing the company’s chances of reaching its business objectives:

- a comprehensive IP strategy with clear guideposts for the steps necessary to achieve funding milestones, including a strategy for any potential in-licensing of third-party IP,

- a coordinated regulatory strategy to avoid self-inflicted wounds down the road and increase attractiveness to investors or acquirers,

- a financing and commercialization strategy that matches the company’s regulatory milestones and value inflection points with the optimal sources of capital each stage of its development, and

- a corporate strategy that supports future growth while minimizing risks and maximizing tax efficiencies.

With ARPA-H’s support, Cellino will build a cassette-based biomanufacturing technology capable of scaling the production of personalized regenerative cells (induced pluripotent stem cells) at hospitals nationwide to develop curative medicines for a range of chronic conditions for an increasingly diverse and aging U.S. patient population.

Cellino’s proprietary biomanufacturing technology automates traditionally manual, artisanal processes using an AI-guided, laser-based cell management process to reduce variability and increase the consistency of biomanufactured cell and tissue products. Cellino’s proprietary optical bioprocess will drive a meaningful cost reduction for personalized regenerative medicine biomanufacturing using patient-specific closed cassettes. This effort aligns with ARPA-H’s mission to improve health outcomes for everyone.

Cellino has been a Wilson Sonsini client since 2020, and Wilson Sonsini partner Jen Fang has been advising Cellino on the award and other related matters. For more information on the ARPA-H award, please see Cellino’s news release.

With ARPA-H’s support, Cellino will build a cassette-based biomanufacturing technology capable of scaling the production of personalized regenerative cells (induced pluripotent stem cells) at hospitals nationwide to develop curative medicines for a range of chronic conditions for an increasingly diverse and aging U.S. patient population.

Cellino’s proprietary biomanufacturing technology automates traditionally manual, artisanal processes using an AI-guided, laser-based cell management process to reduce variability and increase the consistency of biomanufactured cell and tissue products. Cellino’s proprietary optical bioprocess will drive a meaningful cost reduction for personalized regenerative medicine biomanufacturing using patient-specific closed cassettes. This effort aligns with ARPA-H’s mission to improve health outcomes for everyone.

Cellino has been a Wilson Sonsini client since 2020, and Wilson Sonsini partner Jen Fang has been advising Cellino on the award and other related matters. For more information on the ARPA-H award, please see Cellino’s news release.

We know that it takes more than breakthrough science to build a viable company because we have helped more than 2,000 life sciences founders and entrepreneurs do just that. From developing and protecting innovation to ensuring regulatory compliance to identifying the right board members and the best sources of capital, we help make your business journey feasible, easier, and more predictable.

We have creative and flexible ways to work with entrepreneurs and their limited starting funds. Our innovative approach to serving emerging life sciences companies also includes using technology to streamline, automate, and digitize the legal processes typical for a start-up. Through our new platform, Neuron, we are combining our legal expertise and business know-how with digital automation to provide highly responsive yet cost-effective legal services.

Our firm has helped raise more than 1,300 venture financing rounds totaling more than $14 billion. This experience and our industry relationships give us an unparalleled insight into the various capitalization tools available to emerging life sciences companies, even during economic downturns. To help our clients find the funding they need, we often make strategic introductions and frequently host events attended by life sciences innovators, entrepreneurs, and investors.

We know that it takes more than breakthrough science to build a viable company because we have helped more than 2,000 life sciences founders and entrepreneurs do just that. From developing and protecting innovation to ensuring regulatory compliance to identifying the right board members and the best sources of capital, we help make your business journey feasible, easier, and more predictable.

We have creative and flexible ways to work with entrepreneurs and their limited starting funds. Our innovative approach to serving emerging life sciences companies also includes using technology to streamline, automate, and digitize the legal processes typical for a start-up. Through our new platform, Neuron, we are combining our legal expertise and business know-how with digital automation to provide highly responsive yet cost-effective legal services.

Our firm has helped raise more than 1,300 venture financing rounds totaling more than $14 billion. This experience and our industry relationships give us an unparalleled insight into the various capitalization tools available to emerging life sciences companies, even during economic downturns. To help our clients find the funding they need, we often make strategic introductions and frequently host events attended by life sciences innovators, entrepreneurs, and investors.

Wilson Sonsini has represented clients in thousands of venture finance deals. Investors rely on our unmatched experience in venture finance dealmaking and our deep focus on life sciences to help them identify, manage, and exit promising ventures. We help them understand and strengthen their life sciences portfolios from the scientific, IP, and regulatory perspectives as well as source new opportunities in emerging areas of life sciences innovation. With our finger on the pulse of the industry, we are able to find the optimal venture capital investment opportunity at each stage in the development of an emerging growth company.

Private equity firms also engage us to act as strategic advisors for their portfolio companies, counseling these emerging companies on all aspects of forming, growing, and exiting a successful life sciences enterprise. Moreover, our strong relationships with entrepreneurs, innovators, research institutions, incubators and accelerators, and biopharmaceutical companies enable us to introduce investors to stellar potential board and management team members who can helm portfolio companies for a greater chance of success.

Wilson Sonsini has represented clients in thousands of venture finance deals. Investors rely on our unmatched experience in venture finance dealmaking and our deep focus on life sciences to help them identify, manage, and exit promising ventures. We help them understand and strengthen their life sciences portfolios from the scientific, IP, and regulatory perspectives as well as source new opportunities in emerging areas of life sciences innovation. With our finger on the pulse of the industry, we are able to find the optimal venture capital investment opportunity at each stage in the development of an emerging growth company.

Private equity firms also engage us to act as strategic advisors for their portfolio companies, counseling these emerging companies on all aspects of forming, growing, and exiting a successful life sciences enterprise. Moreover, our strong relationships with entrepreneurs, innovators, research institutions, incubators and accelerators, and biopharmaceutical companies enable us to introduce investors to stellar potential board and management team members who can helm portfolio companies for a greater chance of success.

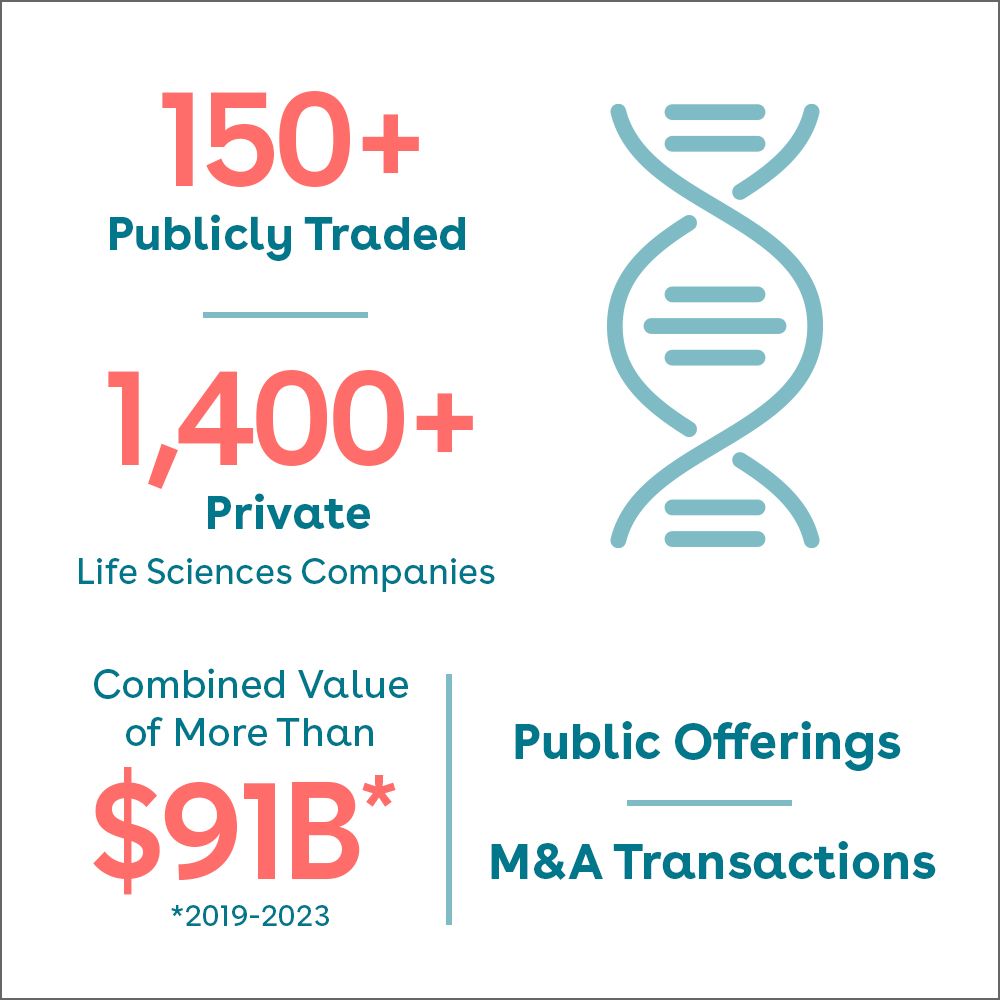

Established life sciences enterprises, including medical device, diagnostics, and biological tools and services companies, turn to us for assistance with their exit strategies. We have worked with thousands of companies to conclude successful sales, initial public offerings, or strategic collaborations. From 2019 to 2023, we have completed hundreds of life-sciences-related public offerings and M&A transactions with a combined value of greater than $91 billion, including deals that required highly complex M&A structures. We have also counseled hundreds of life sciences companies on structuring strategic commercial collaborations.

Our experience advising companies on both the buy and sell sides of the negotiation table includes virtually every type of M&A transaction, including small “tuck-in” acquisitions, strategic mergers and business combinations, complex cross-border deals, spin-offs, and tangible and intangible asset acquisitions. Our M&A work has garnered awards and recognitions, and we have been consistently ranked among the top M&A advisers across all industries in the U.S. by sources such as Refinitiv, Bloomberg, and Mergermarket.

For companies looking to an IPO as their exit strategy, our comprehensive process, honed over hundreds of deals, ensures that the IPO is the precursor to realizing the client’s business vision for years to come. We know that successful IPOs require a dedicated team for the duration of the transaction, leveraging the connections of the entire firm, including at the highest levels of the U.S. Securities and Exchange Commission and national exchanges, managing all aspects of the offering, and being prepared to handle unexpected hurdles, from competitor actions to government shutdowns and shifting economic and market conditions.

As the firm's attorneys nurtured promising start-ups through the business life cycle, many opted to go public. The evolution of our clients from privately held to public companies is one reason why Wilson Sonsini successfully built a respected, top-ranked public company practice. The firm has more than 150 public life sciences company clients and a sterling reputation as an adviser to corporations, boards of directors, and board committees.

Established life sciences enterprises, including medical device, diagnostics, and biological tools and services companies, turn to us for assistance with their exit strategies. We have worked with thousands of companies to conclude successful sales, initial public offerings, or strategic collaborations. From 2019 to 2023, we have completed hundreds of life-sciences-related public offerings and M&A transactions with a combined value of greater than $91 billion, including deals that required highly complex M&A structures. We have also counseled hundreds of life sciences companies on structuring strategic commercial collaborations.

Our experience advising companies on both the buy and sell sides of the negotiation table includes virtually every type of M&A transaction, including small “tuck-in” acquisitions, strategic mergers and business combinations, complex cross-border deals, spin-offs, and tangible and intangible asset acquisitions. Our M&A work has garnered awards and recognitions, and we have been consistently ranked among the top M&A advisers across all industries in the U.S. by sources such as Refinitiv, Bloomberg, and Mergermarket.

For companies looking to an IPO as their exit strategy, our comprehensive process, honed over hundreds of deals, ensures that the IPO is the precursor to realizing the client’s business vision for years to come. We know that successful IPOs require a dedicated team for the duration of the transaction, leveraging the connections of the entire firm, including at the highest levels of the U.S. Securities and Exchange Commission and national exchanges, managing all aspects of the offering, and being prepared to handle unexpected hurdles, from competitor actions to government shutdowns and shifting economic and market conditions.

As the firm's attorneys nurtured promising start-ups through the business life cycle, many opted to go public. The evolution of our clients from privately held to public companies is one reason why Wilson Sonsini successfully built a respected, top-ranked public company practice. The firm has more than 150 public life sciences company clients and a sterling reputation as an adviser to corporations, boards of directors, and board committees.

Wilson Sonsini offers a suite of services for life sciences clients navigating the complexities of initial public offerings (IPOs). Leveraging the scientific expertise of the firm’s Patents and Innovations and Corporate practices, our team provides specialized business and technical writing services, including drafting the business section of the registration statement, preparing investor presentations, and handling other technical writing needed during the IPO process.

Uniquely, our life sciences-focused patent team consists of more than 170 legal professionals with Ph.D.s and other advanced degrees in biology, chemistry, biomedical sciences, or engineering. Our technical writing expertise encompasses biopharmaceuticals, small molecule therapeutics, research tools, medical devices, genomics, bioinformatics, artificial intelligence, and materials. Because our professionals are credentialed scientists who are intimately familiar with the science at the core of the client’s business, as scientific writers, they are well positioned to draft a Form S-1 or Form F-1 business section that meets the SEC’s exacting standards for registration statements, dovetails with the client’s patent strategy, and tells a compelling and exciting story about the client’s technology, business, and value proposition to educate potential investors.

The firm has a 60-plus-year history of representing trailblazers in the life sciences industry—from the earliest innovators to those that are shaping the future of healthcare today. We work closely with entrepreneurs, scientists, and investors who trust Wilson Sonsini’s strategic advice to establish and realize their companies’ business objectives. We represent life sciences companies through the entire business life cycle, from formation through IPO and strategic partnerships. We often act as outside general counsel with support from our cross-functional, global life sciences team to provide coordinated and comprehensive counsel to clients. This breadth of experience informs our IPO-related scientific writing and allows us to produce optimal capitalization results for our clients.

Wilson Sonsini’s IPO scientific writers are professionals in global patent portfolio development and management. They include former senior technology licensing executives at top-tier research universities and former in-house legal counsel for major life sciences companies.

The unparalleled combination of our scientific backgrounds and industry experience enables us to accelerate and streamline the IPO process by producing a business description in advance of an IPO organizational meeting, thereby allowing management to maintain its focus on operating the business.

Wilson Sonsini offers a suite of services for life sciences clients navigating the complexities of initial public offerings (IPOs). Leveraging the scientific expertise of the firm’s Patents and Innovations and Corporate practices, our team provides specialized business and technical writing services, including drafting the business section of the registration statement, preparing investor presentations, and handling other technical writing needed during the IPO process.

Uniquely, our life sciences-focused patent team consists of more than 170 legal professionals with Ph.D.s and other advanced degrees in biology, chemistry, biomedical sciences, or engineering. Our technical writing expertise encompasses biopharmaceuticals, small molecule therapeutics, research tools, medical devices, genomics, bioinformatics, artificial intelligence, and materials. Because our professionals are credentialed scientists who are intimately familiar with the science at the core of the client’s business, as scientific writers, they are well positioned to draft a Form S-1 or Form F-1 business section that meets the SEC’s exacting standards for registration statements, dovetails with the client’s patent strategy, and tells a compelling and exciting story about the client’s technology, business, and value proposition to educate potential investors.

The firm has a 60-plus-year history of representing trailblazers in the life sciences industry—from the earliest innovators to those that are shaping the future of healthcare today. We work closely with entrepreneurs, scientists, and investors who trust Wilson Sonsini’s strategic advice to establish and realize their companies’ business objectives. We represent life sciences companies through the entire business life cycle, from formation through IPO and strategic partnerships. We often act as outside general counsel with support from our cross-functional, global life sciences team to provide coordinated and comprehensive counsel to clients. This breadth of experience informs our IPO-related scientific writing and allows us to produce optimal capitalization results for our clients.

Wilson Sonsini’s IPO scientific writers are professionals in global patent portfolio development and management. They include former senior technology licensing executives at top-tier research universities and former in-house legal counsel for major life sciences companies.

The unparalleled combination of our scientific backgrounds and industry experience enables us to accelerate and streamline the IPO process by producing a business description in advance of an IPO organizational meeting, thereby allowing management to maintain its focus on operating the business.

- Capital Markets

- Corporate

- FDA Regulatory, Healthcare, and Consumer Products

- Emerging Companies and Venture Capital

- Finance and Structured Finance

- Life Sciences Business Advisory Practice

- Mergers & Acquisitions

- Patents and Innovations

- Private Equity

- Public Company Representation

- Regulatory

- Technology Transactions

- Privacy Policy

- Terms of Use

- Accessibility